A Quick Agreement

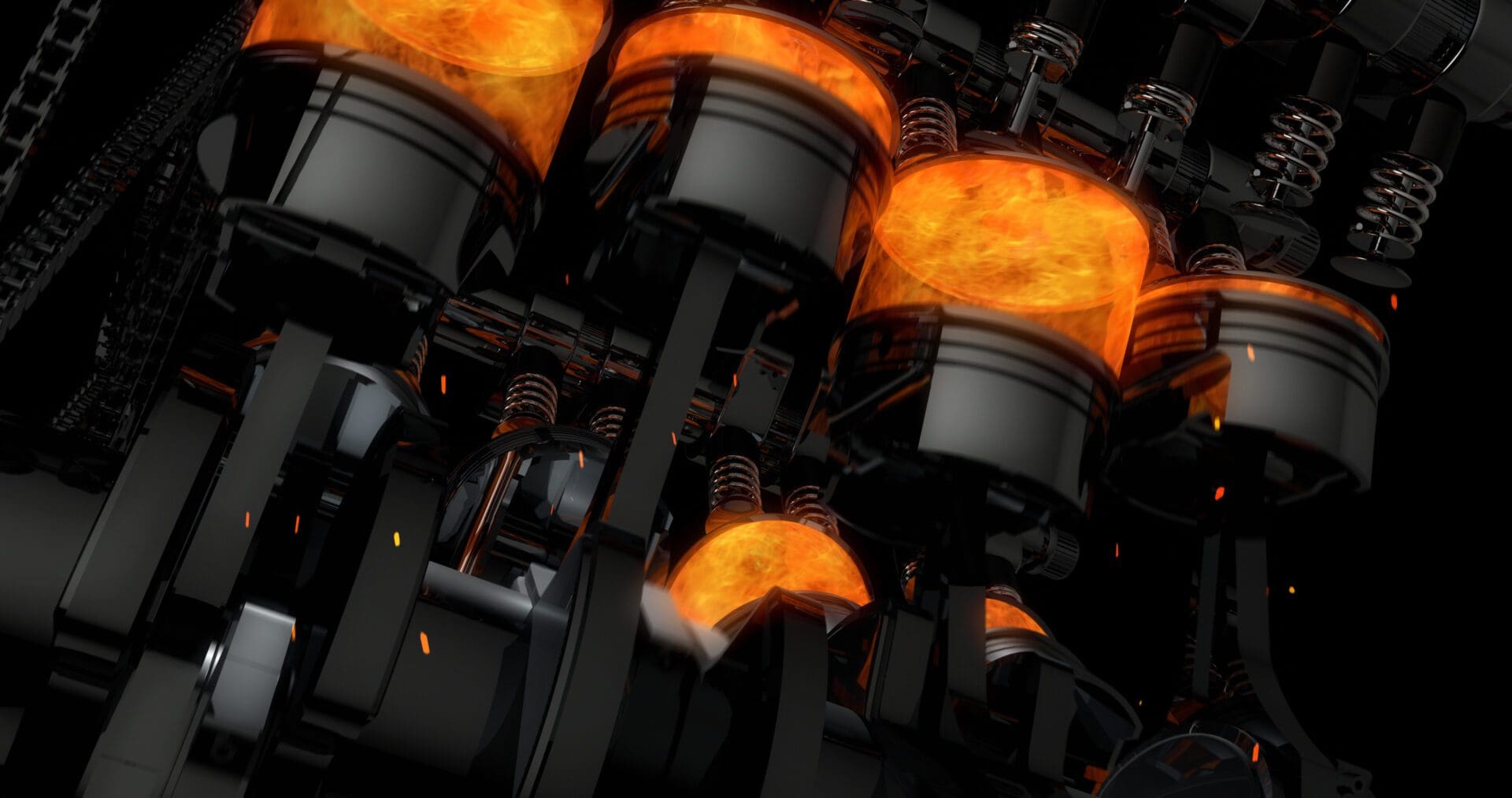

EU legislators reached an agreement Thursday night to impose a 2035 deadline for new passenger cars and vans to be emissions-free. The agreement secures the European Commission’s first victory as it attempts to pass a significant package of green rules, but it comes at the expense of one of the continent’s most important economic products: the gas-guzzling automobile engine. After hours of talks, EU Green Deal chief Frans Timmermans declared, ‘The agreement…sends a strong signal to industry and consumers: Europe is embracing the transformation to zero-emission mobility.’

Senior German politicians, auto industry leaders, and a portion of the country’s once-dominant auto industry that had vehemently lobbied against relying solely on battery-electric vehicles as part of efforts to combat transportation emissions have been sidestepped by Brussels in the confirmation of the engine ban. The EU’s position as an innovator may not endure for long, as states like California and New York are considering enacting their own clean car rules by 2035, and other major countries are also considering similar regulations. Norway, the world leader in electric vehicles, will arrive in 2025. Older vehicles already on the road in 2035 won’t be impacted by the new EU regulations, but the goal is for all cars and trucks in the EU to have zero emissions by the year 2050.

The biggest shock about Brussels is how simple it was to get here. With lobbying and requests for exemptions and special circumstances for anything from sports cars to SUVs, previous EU attempts to legislate small increases in vehicle fuel efficiency standards dragged on for years. This time, it has taken little over 15 months after the legislation was initially tabled in July of last year to decide on the 2035 phaseout target.

One official of the European Parliament described the agreement’s timing as ‘a symbolic gesture that the EU is striving for bigger ambition right now,’ in reference to the COP27 summit that will begin in Egypt on November 6. According to one industry executive, ‘There is a big consensus in the automotive industry that it is time to act. Nobody is disputing that there needs to be an increase in the targets… Instead, it’s only a matter of when and how.’

Alternative Fuels

The greatest economy in Europe and the birthplace of the combustion engine, Germany, has been instrumental in pushing through the new regulations, despite France’s efforts to safeguard plug-in hybrids and Italy’s efforts to defend its luxury super vehicles from the 2035 ban. The new German government, which came into office promising to support the Commission’s Fit for 55 emissions-slashing package but has since been torn by disagreement over the automobile legislation, is largely responsible for the EU’s acceptance of the legally binding 2035 objective.

Numerous automakers, such as Volvo, Ford, and Stellantis, have acted ahead of the EU rule with their own plans to stop selling polluting vehicles by 2035. Others had pushed for additional time or flexibility for plug-in hybrids or e-fuels, a synthetic fuel that is created by mixing atmospheric CO2 and hydrogen and can be used in conventional engines. These included Renault, Zipse’s BMW, and, more recently, Volkswagen.

The liberal Free Democrats, who run the finance and transport ministries, insisted on finding a loophole that would allow sales of vehicles with e-fuel-powered engines to continue even after that date, in contrast to the German Greens, who control the economy, climate, and environment ministries in Berlin. Despite attempts by Finance Minister Christian Lindner to actively engage senior EU officials to carve out a role for e-fuels, the internal disagreement ultimately moderated Germany’s resistance to the law in Brussels.

Hungary requested assistance for a last-ditch effort to modify the law so that the Commission would have to commit to e-fuels at a private meeting of EU ambassadors last Friday, with the help of auto countries Italy, Romania, and Slovakia. Prior to Thursday’s crucial discussions with MEPs, diplomats from other nations rejected that plan. This rejection paved the path for a compromise confirming the 2035 goal. Since the accord doesn’t address the larger sticker price issue that some people still find electric vehicles to be prohibitively expensive, critics assert that it eventually won’t completely clean up transportation.

According to Jens Gieseke, a German conservative MEP who wanted e-fuels included, a ‘Havana effect’ is becoming more probable as a result of the agreement. ‘After 2035, it’s possible that vintage cars could dominate our streets due to a lack of new electric vehicles or their high cost.’

According to Gieseke and some of the auto industry, mandating a switch to electric cars within Europe won’t help decarbonize the estimated 1.3 billion cars already in use around the world because combustion engines will continue to be marketed in large quantities in developing nations. Additionally, Oliver Zipse, CEO of BMW, who represents the bloc’s automakers as president of the Brussels-based ACEA association, said that in order to achieve the 2035 target domestically, significant investments will be needed in the infrastructure for charging electric vehicles. These investments will also necessitate efforts to secure access to the raw materials required to construct millions of new battery cells.

China

Critics worry that the EU regulations may support rebel Chinese automakers. This month, Chinese automakers BYD and Great Wall introduced new all-electric model lineups at the Paris Motor Show that were specifically targeted at the European market. The world’s largest producer of batteries, China, provides the new entrants with reliable supply to batteries and spares them the expense of moving an existing workforce away from producing combustion engines.

Carlos Tavares, CEO of automobile manufacturer Stellantis, stated this week at a conference in Berlin that this turns EU emission standards into an ‘advantage’ for Chinese upstarts since it restricts the market for sales of high-profit vehicles outfitted with combustion engines made in Europe. Given that follow-up legislation known as Euro 7 is imminent, the Commission is attempting to be kind with automakers when it comes to regulating non-CO2 emissions in November. This change will include harmful exhaust gases including nitrogen oxides and ammonia as well as minute particles from brakes, tires, and exhausts.

An early draft claims that the language will ‘minimize’ the industry’s new standards, lessening the financial strain on automakers who would otherwise have to invest in creating a new generation of exhaust technology that might comply with stricter laws. One EU diplomat asserted that the 2035 target is being balanced with less onerous Euro 7 regulations that will allow carmakers to continue selling profitable models up until the zero CO2 emissions mandate goes into effect, arguing that ‘effectively, the industry has accepted that there will be a ban on the combustion engine.’

The ambassador claimed that ‘their only goal is to sell as many cars as they can before 2035.’ The EU’s fleet will transition to zero-emission vehicles only by 2050, the deadline by which capitals have promised to be net zero, according to the new 2035 objective. With an average age of just under 12 years, the EU is on course to meet this goal. Next year, separate CO2 rules legislation for trucks and other large vehicles is expected. The unanswered question is whether European automakers will maintain their position as the world’s top automobile manufacturers or if China would usurp them in that regard as a result of the engine’s demise.

According to Alex Keynes of the environmental organization Transport & Environment, ‘European automakers are in a race to lead the world in electric vehicles. Don’t lift your foot off the gas pedal right now.’

Related Articles: