Just over a year ago, Hungary became the first country in Europe to sign a deal with Turkmenistan for the import of natural gas, further diversifying the European Union’s energy supply by bringing in yet another energy-rich country from Central Asia. Hungary now has the potential to become a key hub in the EU for Turkmen natural gas exports.

On 20 August 20 in 2023 a landmark agreement was signed between the two countries for the supply of natural gas from Turkmenistan to Hungary.

This agreement is historic, as it marks the first time Turkmen natural gas will be supplied to Europe,

despite Turkmenistan’s long-standing policy of neutrality. The deal involves a swap arrangement, whereby natural gas is supplied from Turkmenistan to Iran. From there, the gas is transferred to the existing Southern Gas Corridor via Azerbaijan, utilizing the Baku–Tbilisi–Erzurum, Trans-Anatolian (TANAP), and Trans-Adriatic (TAP) pipelines. These pipelines connect to various interconnectors in Europe, ultimately delivering the gas to the Hungarian market through the Serbia–Hungary natural gas interconnector, which was completed in 2023.

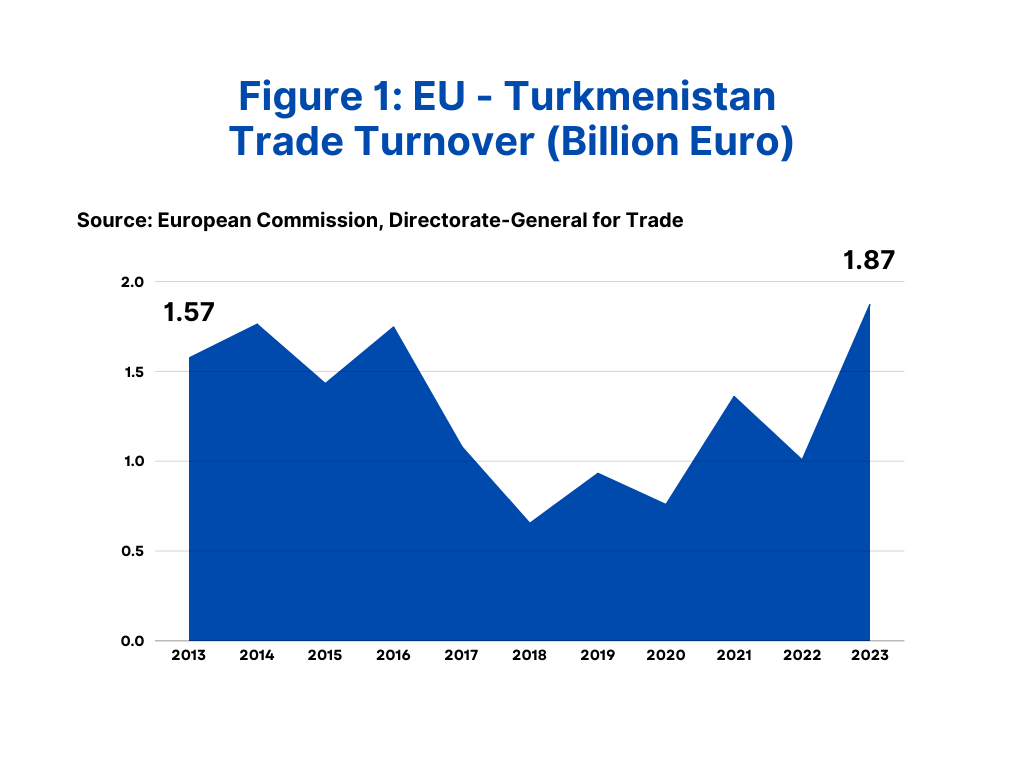

The trade relations between the EU and Turkmenistan experienced a continuous decline between 2013 and 2020. However, greater access to the Central Asian market for both the EU and Türkiye, facilitated by peace prospects in the South Caucasus and the Ukraine crisis, has helped restore trade turnover to previous levels. Hungary could serve as a further catalyst in strengthening trade relations with energy-rich Turkmenistan.

Figure 1 illustrates the changes in trade turnover between the EU and Turkmenistan from 2013 to 2023. In 2013 and 2014, trade turnover stood at 1.57 billion euros and 1.76 billion euros, respectively. However, by 2018, it had fallen sharply to 652 million euros, and despite a slight recovery to 756 million euros in 2020, the COVID-19 pandemic negatively impacted global trade, including between the EU and Turkmenistan. Despite this, trade witnessed a significant resurgence in 2021, nearly doubling from the previous year to reach 1.36 billion euros. Another key development occurred in 2023 when, after a slight dip in 2022, trade turnover rebounded to 1.87 billion euros, marking a return to positive dynamics. Notably, from 2013 to 2022, the EU consistently maintained a positive trade balance with Turkmenistan. However, in 2023, this trend reversed, resulting in a substantial negative trade balance. This shift was driven by a significant increase in imports from Turkmenistan, particularly in mineral fuels. According to the European Commission’s Directorate-General for Trade, the EU imported mineral fuels worth 1.057 billion euros from Turkmenistan in 2023. This surge in fuel imports is expected to continue if the EU maintains its commitment and support for such trade expansion.

The Second Karabakh War in 2020 significantly altered the geopolitical landscape of the South Caucasus, opening up opportunities for stabilization and peace in the region. The improved security of the South Caucasus route has paved the way for increased engagement by Türkiye and the European Union in Central Asia. This shift became possible due to the restoration of Azerbaijan’s territorial integrity following its 30-year-long conflict with Armenia.

Even before the war, Azerbaijan had been actively promoting the Middle Corridor by funding projects such as the construction of the Baku–Tbilisi–Kars railway and expanding the capacity of the Port of Baku. In the aftermath of the war, Azerbaijan intensified its efforts through numerous official visits and active promotion of the Trans-Caspian Trade Route.

Both Azerbaijan and Türkiye have supported the idea of Turkmen gas reaching Europe.

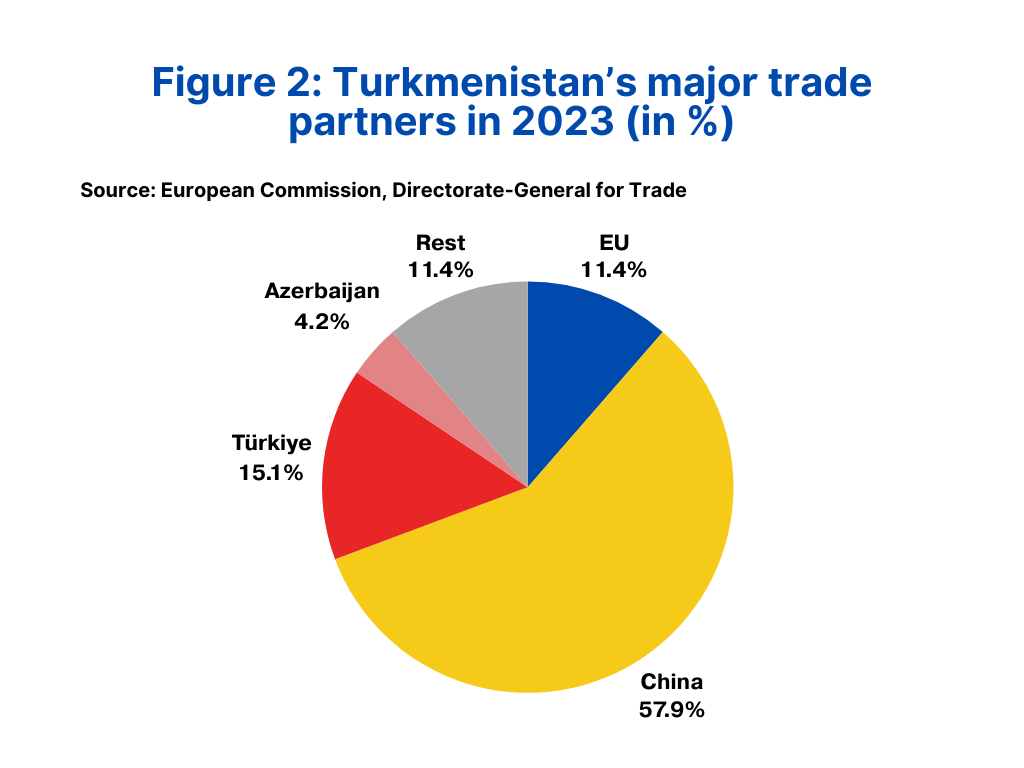

Consequently, several swap agreements have been signed with Iran and Turkmenistan, leading to both countries becoming the 3rd and 4th largest trade partners of Turkmenistan, respectively, as shown in Figure 2.

China remains Turkmenistan’s largest trade partner, accounting for nearly 58 per cent of the country’s total trade turnover. This is primarily due to Turkmenistan being China’s largest natural gas supplier. In the first 10 months of 2023 alone, China imported 96.51 million tons of natural gas from Turkmenistan, valued at 8.07 billion US dollars. The European Union is also a key trading partner, particularly in fuel imports from Turkmenistan, placing the EU in 3rd position in terms of trade volume.

Turkmenistan’s external trade is heavily reliant on the export of natural gas to neighbouring regions and countries, including China, South Asia, and potentially the European Union. Hungary, given its strong relations with the Central Asian countries and its presidency of the Council of the EU, is well-positioned to play a leading role in expanding fuel imports from Turkmenistan.

Given Hungary’s Eastern Opening Policy, the country has been proactive in fostering economic and political relations with Central Asian nations. A key focus of these relations has been energy, encompassing both fossil fuels and green energy. This strategic engagement has made Hungary the first European country to sign an agreement for importing natural gas from Turkmenistan. Although the expected volume of 1 billion cubic metres is modest relative to Europe’s large energy consumption, it marks a significant step in diversifying energy sources. However, the full potential for exporting larger volumes of gas to Europe is hindered by infrastructure limitations, particularly in Iran, as seen in the current swap agreement between Azerbaijan, Iran, and Turkmenistan.

Turkmenistan, which holds the world’s 6th largest natural gas reserves, has expressed its willingness to support greater exports to Europe, particularly through the construction of the Trans-Caspian pipeline.

This project could significantly boost Turkmen gas exports to the EU, offering a cheaper and long-term alternative to Russian gas.

However, major obstacles remain, particularly the lack of funding and opposition from Russia and Iran. Nevertheless, with EU support, this pipeline could be realized, securing Europe’s energy diversification and enhancing the EU’s geopolitical footprint in Central Asia.

As Hungary holds the presidency of the Council of the EU, it can leverage its influence to set the EU’s agenda in favour of increased imports of Turkmen gas, presenting it as a strategic and cost-effective alternative to Russian energy dependence. This would not only support Hungary’s energy strategy but also align with the broader EU goals of securing diverse and reliable energy sources while enhancing its presence in the geopolitically significant Central Asian region.

Read more from the author: