Hungarian Conservative is launching a ten-part series of articles on the past decade and a half of the Hungarian economy and society, titled ‘Revealing the Facts’. Rather than looking at a lot of different, isolated data it is worth providing an overview, comparing and analysing trends over time, in order to understand the details. Our first article focuses on the history and context of inflation.

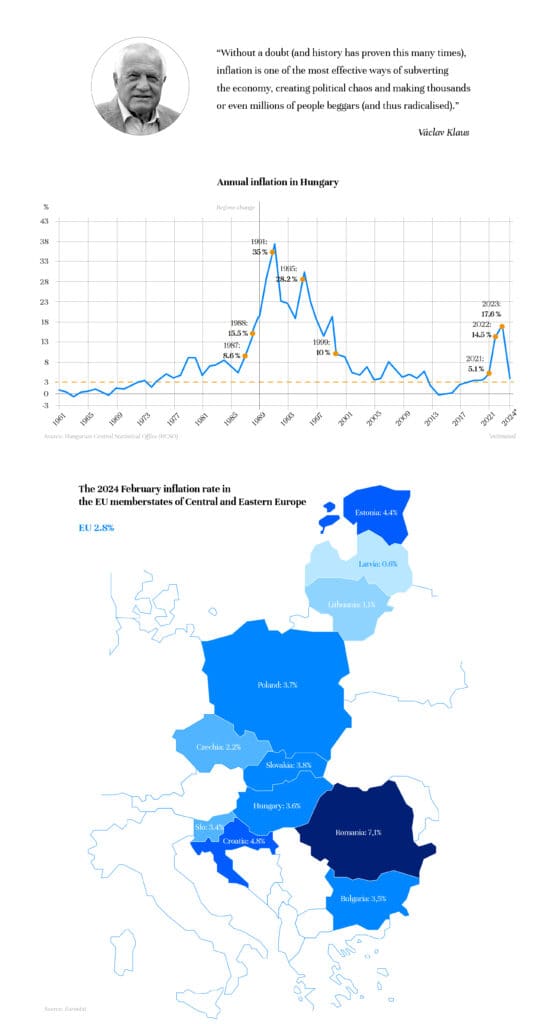

We Hungarians are particularly sensitive to rising inflation, and we have plenty of painful experience of what happens when our money depreciates significantly. In his book The Return of Inflation, Czech academic economist Václav Klaus writes: ‘Without a doubt (and history has proven this many times), inflation is one of the most effective ways of subverting the economy, creating political chaos and making thousands or even millions of people beggars (and thus radicalised).’ Klaus was Minister of Finance in the first Prague government during the Velvet Revolution, then Prime Minister of the Czech Republic from 1992 to 1997 and President of the Republic from 2003 to 2013. He wrote these lines in 2022, when it was still unclear whether and how inflation would be stopped.

History of Inflation in Hungary since the Middle of the Last Century

After the Second World War, Hungary experienced the biggest price increase in the world. All Hungarians know stories about how our grandparents and great-grandparents survived hyperinflation—a monthly increase in the price level of more than 50 per cent—that lasted from July 1945 to 1 August 1946, until the introduction of the Hungarian forint (HUF), which is still in use today. Hyperinflation is defined as a monthly increase in the price level of more than 50 per cent. During this period, monthly inflation was almost 41,900 billion (4.19 × 10^16) per cent, with prices doubling every 15 hours. Fortunately, after the introduction of the forint, we experienced almost three decades of stable prices between 1951 and 1979, which many people still remember with nostalgia.

The most significant inflation in the 78-year history of the forint occurred during the regime change.

Annual inflation was in double digits for more than a decade between 1988 and 1999.

The worst year of this period was 1991, when annual inflation averaged 35 per cent. Indeed, all the countries that changed their regime paid a huge price for freedom, and many of them have only been able to stop the inflation that had developed by changing currencies, i.e. by introducing a new currency. Fortunately, we have not seen such a drastic escalation of economic deterioration during this period. The Hungarian inflation curve showed a double peak in 1991 and 1995. The second peak occurred during the Socialist government, when the highest monthly inflation rate was 31 per cent in June 1995. Lajos Bokros, the finance minister of the Horn government (a coalition of the Hungarian Socialist Party and the Alliance of Free Democrats which came to power in 1994) stabilized the country’s solvency with inflationary measures that impoverished the population.

Inflation after 2010

From the turn of the millennium until 2013, under the then left-wing central bank leadership, we had inflation well above that of the euro, at between 4 and 8 per cent, which was much higher than the inflation target of 3 per cent +- 1 percentage point. The target range was first reached in 2013, when the central bank came under new leadership. They put much more emphasis on reducing inflation and therefore set much lower interest rates to boost lending and thus the economy.

Since 2013, the government has also taken several measures that have further helped to reduce inflation. The most significant was the reduction of household utility costs. Until 2013, Hungary had the highest electricity and gas prices in Europe, both of which were reduced by 25 per cent by 2015. In 2012, 26.7 per cent of the Hungarian population had arrears and 15 per cent were unable to heat their homes properly for financial reasons. By 2021, the share of people in arrears had fallen to 10.3 per cent and the share of those unable to heat their homes to 4.7 per cent, which is clearly the result of Hungary having the cheapest energy prices in the EU.

Inflation Trends in the Polycrisis Period

In 2020, we still had an annual average inflation rate of 3.3 per cent during the COVID–19 pandemic, which meant that we were able to stay within the target range. Household energy prices remained unchanged due to continuing of the utility cost cuts programme; food prices did not rise, and in the case of fuel, the spring price fall during the lockdowns was offset by the July rise.

However, in 2021, news of the tightening of the sanctions introduced against Russia in 2014 led to a global rise in energy prices, which in turn led to a rise in fuel prices in Hungary, pushing inflation in Hungary (from April 2021) and in the euro area (from July 2021) outside the target range.

In 2022, after the outbreak of the Russian war on Ukraine on 24 February, food inflation started in April, and the sanctions on oil and gas caused the price of oil to double on international stock exchanges in the summer, while the price of gas more than quadrupled, which meant that our household energy subsidy system in Hungary had to be changed. From September, the price of energy for households with above-average consumption increased significantly. In the case of fuel, the price freeze in mid-November 2021 protected the population from price increases, but as this made fuel significantly cheaper than in neighbouring countries, foreign purchases increased sales to the point where there was a shortage and the fuel price freeze had to be lifted in mid-December 2022. The perceived disruption to supply chains in 2022, coupled with adverse weather for agriculture (a major drought) only worsened inflation.

However, the price increases over this period also led to a huge increase in the gross operating profit, that is, the profit before tax, of the competitive sector across the economy, as measured by quarterly GDP, in the third and fourth quarters of 2022. This suggests that

businesses implemented price increases that were much larger than the increase in costs.

The government took action to help the Hungarian National Bank’s monetary measures to reduce inflation and to increase competition in the market. First, in early 2023, measures were taken to help speed up the competition oversight procedures of the Hungarian Competition Authority, and then, in May, the very popular online price monitoring system was introduced, making it easier for the public to obtain up-to-date information on prices. As a result of these measures, price rises stopped and, in some cases, even started to fall. Then, as the high-inflation months of 2022 ran out of the base for the annual inflation calculation, inflation fell steadily from 25.7 per cent in January 2023 to 3.8 per cent in January 2024.

We have been outside the inflation target range for 33 months. From the maximum of 25.7 per cent in January 2023, we have been back in the target range in one year. Uniquely, the fall has been faster than the rise.

The Hungarian National Bank forecasts that inflation will remain at the upper end of the tolerance band in the coming months, before rising temporarily in the middle of the year due to base effects, as in other countries, but still at 3.5–5 per cent per year on average, and at 2.5–3.5 per cent in both 2025 and 2026

In the case of the euro, the European Central Bank’s inflation target is to keep inflation below 2 per cent. As of July 2021—31 months ago—the inflation rate in the zone is above the target, and it is not yet clear when it will be below. It peaked in October 2022 and then fell steadily until November 2023, when it started to rise again.

Piroska Szalai is a labour market expert, a researcher at Economy and Competitiveness Research Institute of the Ludovika University of Public Service.

Mátyás Zsolt Varga is a journalist at Mandiner.

Related articles: