The following is a translation of an article written by Viktória Lilla Pató, a researcher at the Institute for Strategic Studies of the University of Public Service, originally published on Ludovika.hu.

In terms of innovation capacity in the European Union, Hungary is in a higher league from 2023. It is one of the leaders regarding, among others, the number of foreign doctoral students, but needs to increase the number of its own degree holders.

The 2023 European Innovation Scoreboard (EIS) highlights that innovation performance across the continent has improved significantly since 2016, by around 8.5 per cent, demonstrating the EU’s ambition to promote a culture of innovation. Twenty-five countries have seen their innovation performance improve over this period, albeit at a slower pace in recent years, while twenty Member States have seen significant increases and seven have seen a decline.

Countries with less robust innovation systems tend to grow more slowly than the EU average.

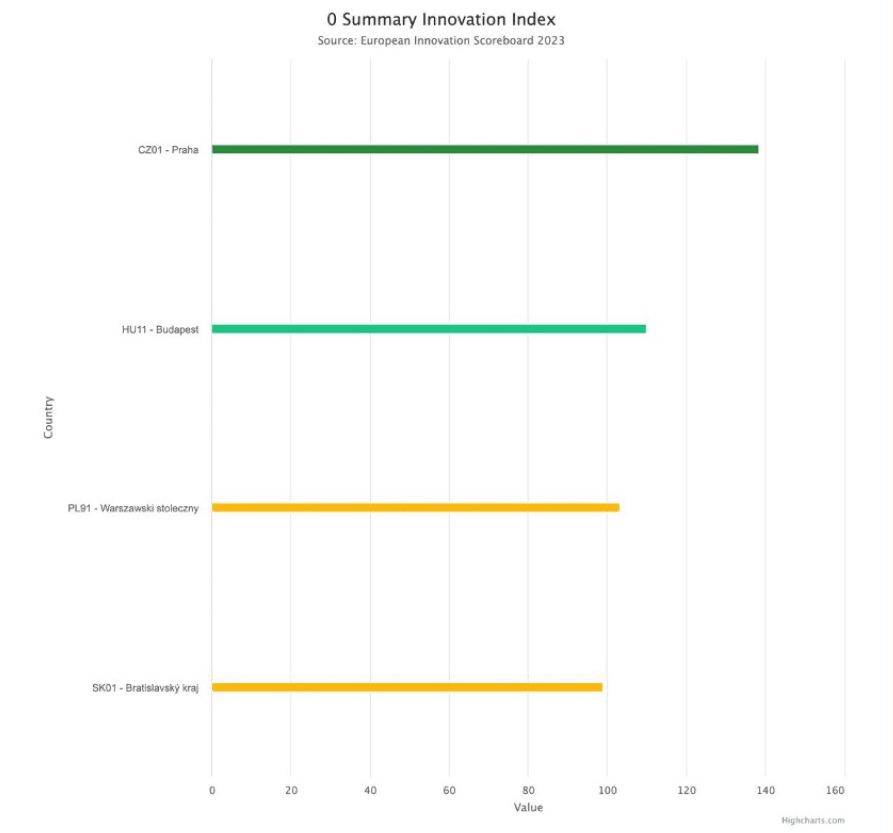

According to the 2023 Regional Innovation Scoreboard (RIS), innovation performance has also improved in most EU regions since 2016. While innovative regions are typically located in the most innovative countries, there are also regions that perform exceptionally well in Member States with relatively weaker overall innovation performance.

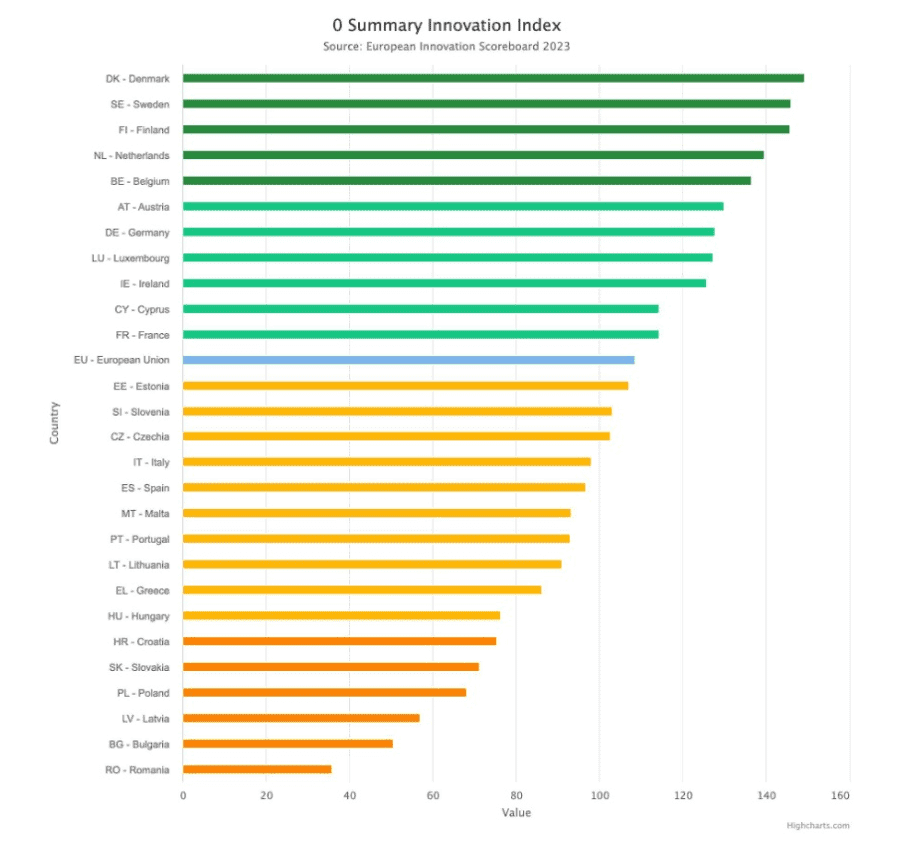

SOURCE: 2023 European Innovation Scoreboard

The scoreboard classifies Member States into four performance groups: Innovation Leaders (with a performance above 125 per cent of the EU average), Strong Innovators (the ones who perform at between 100 per cent and 125 per cent of the EU average), Moderate Innovators (having a performance between 70 per cent and 100 per cent of the EU average), and Emerging Innovators (countries that perform below 70 per cent of the EU average). The table above shows that Denmark is this year’s top innovator, ahead of Sweden, the leader in previous years, closely followed by Finland, then the Netherlands and Belgium as the other Innovation Leaders. Austria, Germany, Luxembourg, Ireland, Cyprus, and France are Strong Innovators, with performances above the EU average. Estonia, Slovenia, Czechia, Italy, Spain, Malta, Portugal, Lithuania, Greece, and Hungary are Moderate Innovators, and finally, Croatia, Slovakia, Poland, Latvia, Bulgaria, and Romania are this year’s Emerging Innovators.

Compared to last year, the distribution of Member States across the performance groups is largely unchanged—however,

Hungary has made significant progress and moved up a whole performance group

to become a Moderate Innovator. France and Luxembourg, on the other hand, have seen their performances fall slightly, highlighting the need for continued improvement in innovation capacity.

Over the period 2016–2023, the performance gap between Member States has narrowed somewhat, most notably between Strong and Moderate Innovators. However, the distribution of performance groups still shows a geographical concentration: Northern and Western Europe are home to Innovation Leaders and most Strong Innovators, while Southern and Eastern Europe are mainly home to Moderate and Emerging Innovators. This year’s scoreboard consists of 32 indicators grouped into twelve dimensions, such as attractive research systems, firm investment in research and development, and use of information technologies.

Given the country profile of Hungary, it is a refreshing achievement that it has moved up a league to Moderate Innovators, even though its performance is 70.4 per cent of the EU average, below the category average, and its performance growth is also slower than that of the EU average. Hungary’s relative strengths include the presence of foreign doctoral students, the provision of public support for business R&D activities, the high number of joint publications between the public and private sectors, the export of medium and high-tech goods, and the mobility of human resources in science and technology. Nevertheless, its main weaknesses include design applications, business process innovators, low employment in innovative enterprises, the number of doctoral students,

and the percentage of the population with higher education degrees.

As for the V4 countries, Czechia, like Hungary, is in the league of Moderate Innovators, but at 94.7 per cent, it is above the category average. Its relative strengths include the level of non-R&D innovation spending, the number of business process innovators, the high number of joint publications between the public and private sectors, and the networking of product innovators and innovative SMEs. Its main weaknesses are patent applications, citation rate of publications, job mobility of human resources in science and technology, the share of the population with higher education degrees, and low level of public support for business R&D activities.

Poland is an Emerging Innovator at 62.8 per cent, with relative strengths in design applications, the number of information technology training courses provided by enterprises, the mobility of human resources in science and technology, the number of trademarks, and the share of the population with higher education degrees. Its main weaknesses are the low number of degree holders, the volume of patent applications, the lack of application of green technologies, the low presence of business process innovators, and the low innovation expenditure per employee.

Slovakia’s relative strengths as an Emerging Innovator at 65.6 per cent of the average are the export of medium and high technology goods, the marketing of innovative products, the promotion of lifelong learning, the reduction of fine particulate air pollution, and the level of non-R&D innovation spending. The biggest weaknesses in the area of science and technology are the mobility of human resources, the low level of corporate sector R&D spending and government support for R&D activities, as well as the low number of patent applications and venture capital spending.

Looking at the map of Europe by region on the interactive statistical table shows that the capitals of the V4 countries perform

one category better in terms of innovation capacity compared to the rest of the countries in the same geographical area.

This is not particularly surprising, but what is striking is that while Warsaw and Bratislava are among Moderate Innovators, Budapest is a Strong Innovator, while Prague falls into the highest category of Innovation Leaders.

SOURCE: 2023 European Innovation Scoreboard

So after an analysis of the changes that have taken place in the V4 countries since 2016, the following trends emerge:

Hungary has seen strong growth in the number of foreign doctoral students, job mobility of science and technology workers, and joint publications between the public and private sectors. However, there has been a sharp decline in the level of public support for business R&D activities, the marketing of innovative products, and the use of environmentally friendly technologies. Czechia has shown a significant increase in the number of business process innovators, venture capital spending, and product innovators. At the same time, there is a strong decrease in the level of public support for business R&D activities, public R&D expenditure, and design applications. In Poland, there is a heavy increase in the provision of information technology training courses by enterprises, the level of public support for business R&D activities, and business process innovators, but there is a notable decrease in the use of environmentally friendly technologies, non-R&D innovation expenditure, and design applications. Finally, Slovakia shows strong growth in lifelong learning, public–private joint publications, and international scientific publications. However, it has seen a sharp decline in the number of doctoral students, the use of green technologies, and the sales of innovative products.

Overall, the V4 countries show changing trends in innovation.

Changes in public R&D support are particularly important, with Hungary and Poland showing progress in this area, while Czechia and Slovakia showing some regress. Hungary has seen outstanding growth in the number of foreign doctoral students since 2016, but this trend has not been followed by an increase in the number of degree holders. Czechia, Poland, and Slovakia are all experiencing a decline in the number of degree holders, despite the fact that Poland, like Hungary, devotes significant resources to R&D activities.

The EU’s global position has not changed significantly compared to last year. Its innovation performance is close to that of China and is catching up with Australia, but the gap between the European Union and Canada, South Korea, and the US has widened in the meantime.

Related articles:

Click here to read the original article.