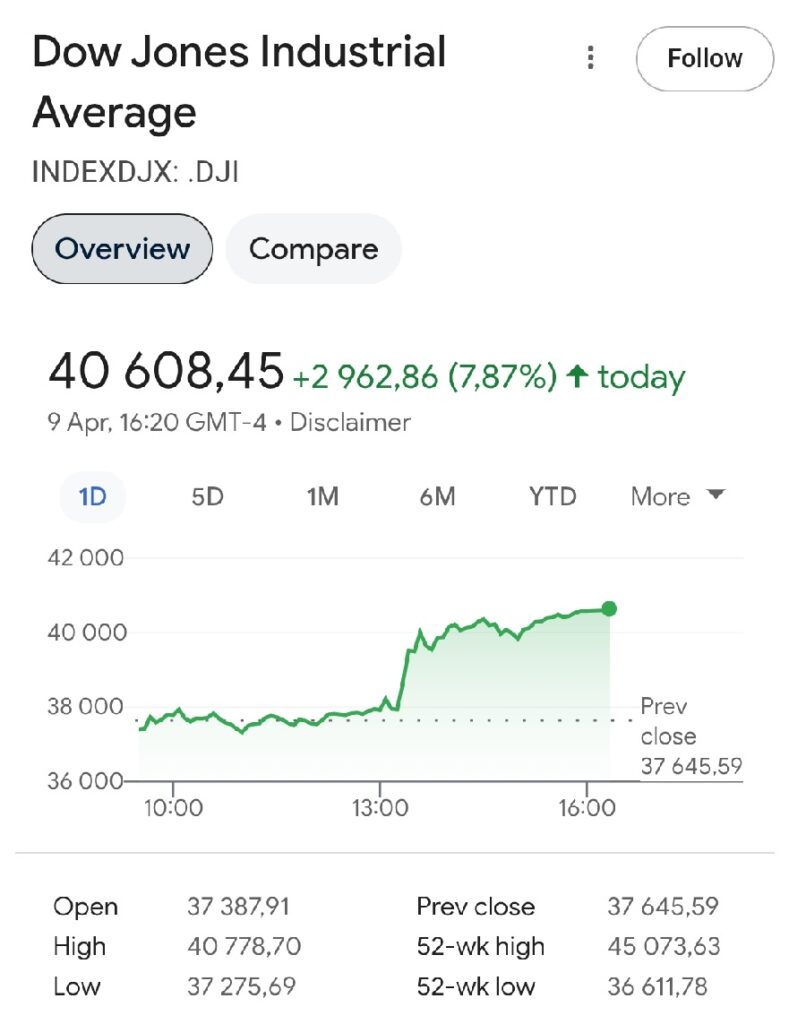

The Dow Jones Industrial Average, the index which tracks the weighted average of 30 large-cap US companies, rose 2,962.86 points on Wednesday, 9 April—the largest daily increase in its history in points. The Dow Jones has been tracking the performance of major US stocks since 1882.

In terms of percentages, that translates to 7.87 per cent, which ranks 19th in the index’s history in terms of daily gains.

Some of the highest-gaining stocks of the day were Elon Musk’s electric car manufacturer Tesla (22.69 per cent, but the stock is not included in the Dow), computer chip manufacturer Nvidia (18.72 per cent), and the electronics and software company Apple (15.33 per cent).

What prompted the market rally was an announcement from President Trump that he is suspending the recently announced tariffs for 90 days for the 75 countries that had offered to negotiate instead of implementing reciprocal tariffs. In the same public message on Truth Social, he also shared that China, which had raised tariffs on US goods in response, would be subjected to an increased tariff rate of 125 per cent.

2025 has not been a good year in the stock market so far.

Even with the recent 8-per-cent gain in a single day, the Dow Jones is still down 4.21 per cent year-to-date. President Trump’s aggressive tariff strategy had been spooking traders ever since the first announcements in early February. In the period since, the POTUS has both talked about tariffs as a long-term solution for raising government revenues without raising taxes and as an incentive to return manufacturing to the US, and as a short-term negotiation tool to coerce foreign countries into signing better trade deals with the US.

This time, however, it seems the administration is fully committed to the latter theory on tariffs, hence the market bull run yesterday. Secretary of the Treasury Scott Bessent has even stated at a press conference at the White House:

‘We saw the successful negotiation strategy that President Trump implemented a week ago today…As I told everyone a week ago, in this very spot, “Do not retaliate and you will be rewarded”. So, every country in the world that wants to come and negotiate, we are willing to hear you. We are going to go down to a 10 per cent baseline tariff for them, and China will be raised to 125 per cent.’

Fox Business senior correspondent Charlie Gasparino, however, claims that high-level sources inside the White House have told him the pause on tariffs came not as part of a pre-agreed strategy, but rather, as a response to Japan, the second largest foreign holder of US bonds after China, selling large quantities of their US bonds in the bond market the day before.

Insiders claim that a faction inside the Trump administration, headed by Trade Counselor Peter Navarro, has been pushing for high tariffs as a long-term solution, while the ‘opposition’ advocating for tariffs as a short-term negotiating tool is headed by Secretary Bessent.

It seems that Bessent’s side has come out on top—hopefully, in the long run.

Related articles: