Europe’s energy dependence on Russian gas and oil has been a constant talking point lately, and not without merit. Stopping Russian energy exports is the biggest Ace up in Putin’s sleeve, giving him enormous leverage over European decision-makers and the development of the sanctions against him. While it’s true that some countries are more affected by this than others, the Russo-Ukrainian war showed us that all of Europe was seriously lagging behind in energy diversification. This is especially true in the case of the Scandinavian, Baltic and Central European countries, for whom Russia represents the biggest supplier (see map below.) To be fair, Central Europe did put a lot of effort into diversifying its gas supplies in the past two decades (remember Nabucco, for instance?) but unfortunately, both Russian and Western corporate interests were against such enterprises.

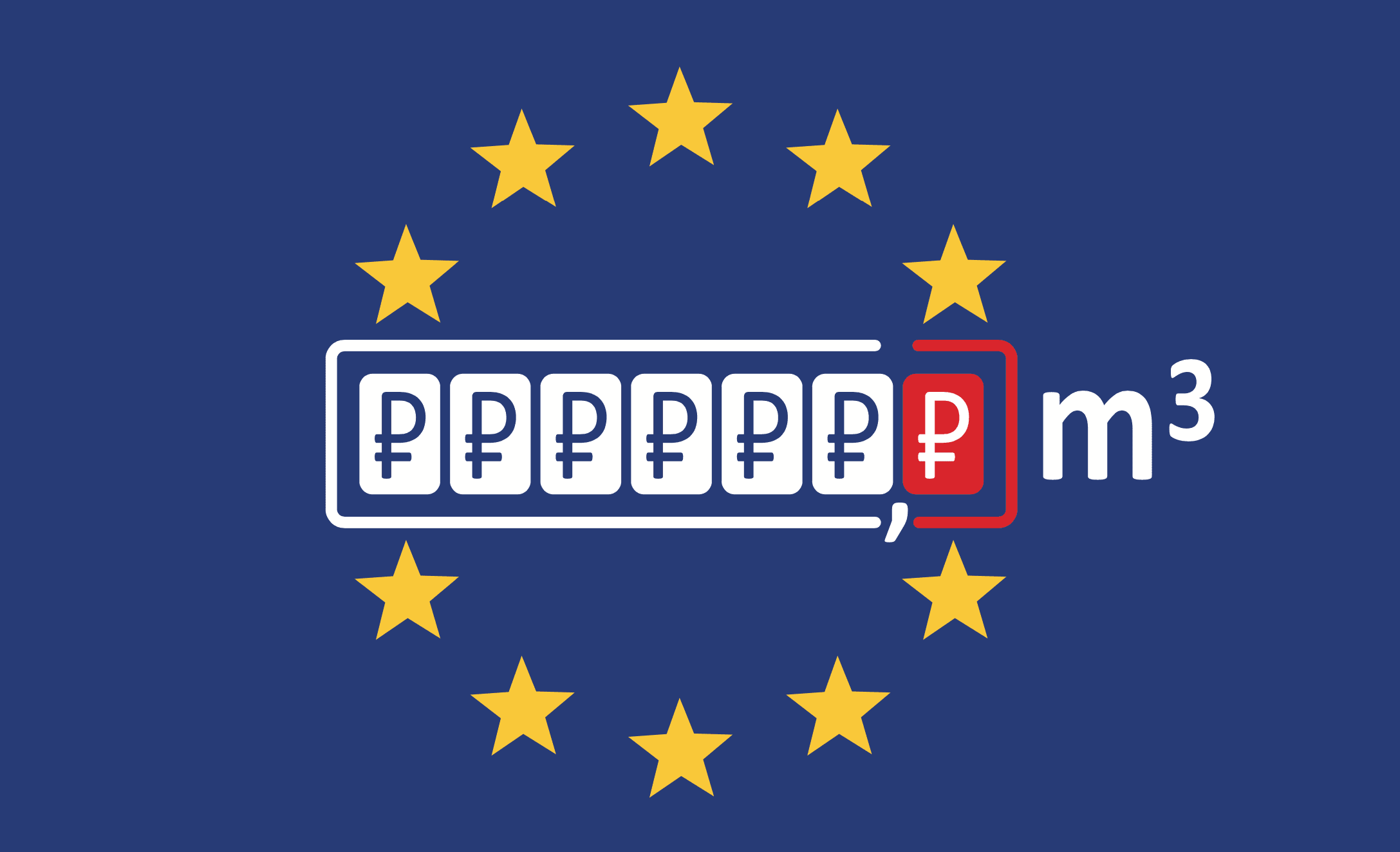

Russia’s ingenious move in order to alleviate the effect of Western sanctions on its economy and protect the purchasing power of its currency was to demand countries to pay for their Russian gas imports in roubles, lest they would risk being cut off entirely. Europe, of course, promptly refused, hoping that Moscow would backtrack on its blackmail because it not only relies heavily on revenues of the energy trade but has also no capacity to store large amounts of withheld gas and oil either. Well, the bet does not seem to pay off so far, and Russia has already stopped exporting gas to Poland and Bulgaria, two of the most outspoken opponents of the rouble option – sending a message to others still on the fence.

Moscow created a transfer scheme specifically to help them circumvent their sanctions

Behind all the fierce rhetoric, however, some European countries have already agreed to make their payments in roubles and their number seems to be growing by the day. To make the process smoother, Moscow even created a transfer scheme specifically to help them circumvent their own sanctions – namely that they open accounts in the Gazprombank, where their euro or dollar-denominated payments can be converted into roubles. Now, this simplified method and the example of Poles and Bulgarians seem to be working as Moscow pressures others to keep its economy afloat in exchange for gas.

Despite the European Union’s official position is that Moscow’s new mechanism for converting payments into Russian currency is still a violation of sanctions, so far ten large European energy companies have opened rouble accounts to do just that. A week before it was only Serbia and Hungary who officially accepted the plan, but now the list includes the largest energy providers of Germany, Austria and Italy as well. Although, we need to mention that while Germany’s Uniper and the Austrian OMV were quite clear on their intentions with their new accounts and even argued against the European Commission’s guidelines, Italy’s Eni refused to confirm that it will follow suit – but what else would they need the Gazprombank for? With these three giant dominos fallen and the European unity splintered, it is just a matter of time until the smaller ones start to crumble as well and slowly give in to Russia’s ingenious blackmail.

The European Commission, meanwhile, is furious that these companies (and effectively, the member states themselves) are ignoring the sanctions, of which even this new mechanism is a clear violation, according to them. Additionally, due to the lengthy nature of the conversion process, the EC said these payments could even be considered loans to Russia from Europe’s largest energy companies. So if we think of the sanctions as our primary tools for weakening Russian economy until the point it can no longer support the Kremlin’s war machine, then its hard to imagine anything more counterproductive than this paying mechanism. Yet here we are, doing exactly that.

Maybe we just need to understand that energy is the one thing we are not able to compromise on. At least not yet. Europe had decades to diversify its supplies, which most of us did not and now we scramble to open a couple of new LNG terminals as if that way we could magically solve our dependence in a matter of weeks.

There are two things we know for certain. One is that Europe is unable to survive without Russian gas for now, but I’m optimistic regarding our future prospects: the current situation will definitely result in a wave of expanding our infrastructures and innovating our way around Russian gas until we no longer need it eventually. The second is that we cannot let the EU fall short in this predominantly European struggle; Russia must be dealt with, just not with energy sanctions. Creating rules that are impossible to uphold for some will only deepen the cleavages within the bloc, and that is the last thing we need right now. So, instead of reprimanding member states like Germany or Hungary for simply trying to survive, the Commission should try to come up with other solutions – ones that would accommodate us all. A united Europe might be our best and only chance, let us not squander that for once.