Hungarian Foreign Minister Péter Szijjártó recently lashed out against the European Union’s ‘de-risking’ approach to China, warning that cutting off the world’s second-largest economy would be ‘a brutal suicide’ for Europe:

‘Political leaders in Europe’, said Szijjártó ‘are not too much interested in the interconnectivity between Europe and China. To the contrary, they are interested in so-called decoupling or de-risking, which, to be honest, according to our understanding, would be a suicide, a brutal suicide committed by the European economy.’

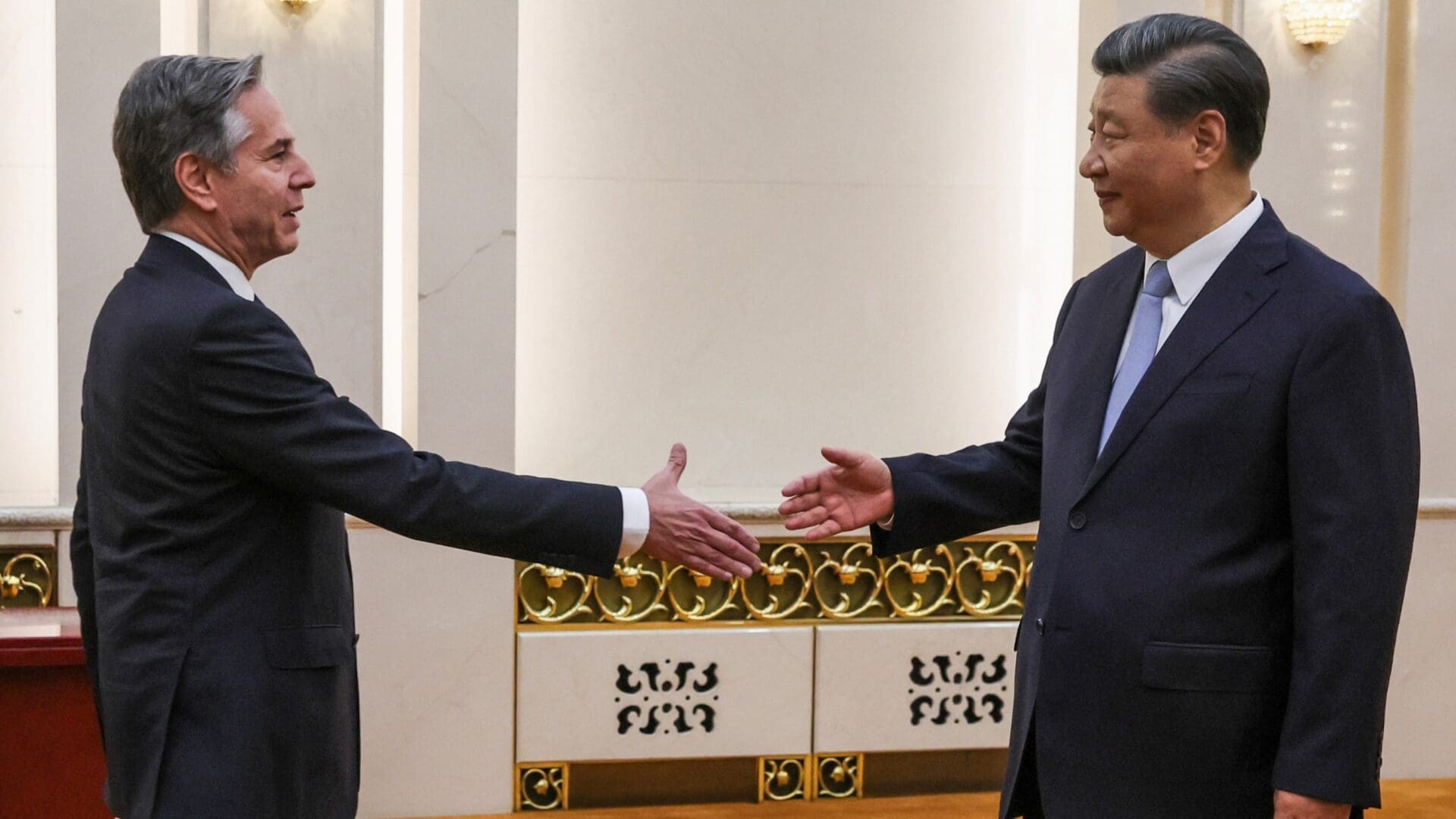

It is not so much the EU’s position, in as much as it is that of the United States. In fact, now that Washington has engaged in ‘de-risking,’ the US and the Western European countries

have found a unifying formula that would contain Chinese hegemony.

What is De-Risking?

The definition of ‘de-risking’, if one were to consult an online dictionary, is ‘to make something safer by reducing the possibility that something bad will happen’. In essence, it means financial institutions or governments terminating or restricting their business relationships with remittance companies and smaller local banks in certain regions. This containment is now being extend to other governments, China in particular.

The term has become rather fashionable among government officials after the joint communiqué of the Leaders of the Group of Seven (G7) who met in Hiroshima this past May. The goal, which is distinct from decoupling, is to loosen Communist China’s hold on global supply chains without severing ties altogether.

When the US first embraced ‘de-risking’ to get Europe on board with measures to deny key technology to China, Chinese officials dismissed the term as no different than decoupling. Indeed, as der Leyen prepares to unveil a road map for ‘de-risking’ economic ties with China, not just Hungary but big member states

have warned against ‘mimicking’ the ‘gung-ho’ approach of the US

—the strategy of ‘de-risking’ is also fuelled over fears of technology theft and strengthening Beijing’s military-industrial complex.

‘De-risking’ has been a major issue in the US since shortly after the 9/11 terrorist attacks and the enactment of the US Patriot Act of 2001 due to unregulated transactions that have funded terrorism. Other factors that have incited ‘de-risking’ have been ‘risk appetite, a lack of clarity regarding regulatory expectations, and regulatory burdens, including compliance with sanctions regimes’.

Hungarian-Chinese Ties

Hungary is widely seen, just as with Russia, as the most ‘China-friendly’ member state of the EU.

Indeed, since Prime Minister Viktor Orbán assumed office, Hungary has strategically increased its rapport with China, notably through its involvement in the Belt and Road Initiative (BRI), Beijing’s global infrastructure plan.

This is part of the policy known as Opening to the East (‘Keleti Nyitás’), which aims to reduce Hungary’s dependence on Western countries and re-orient the country toward the east in the hope of obtaining investments and loans. Orbán began using the designation Opening to the East to describe his government’s trade policy only in the spring of 2011, telling the Hungarian news agency MTI:

‘We are attempting to implement the Opening to the East that we launched over the past year in our system of economic relations. China, South Korea and Japan will become increasingly important economic and commercial partners for Hungary.’

This has been materialised in operations, such as Contemporary Amperex Technology (CATL). Last November,

just days after Szijjártó declared that Hungary fully respects the ‘One China Policy’,

CATL announced that it will build a €7.3 billion plant in the country’s second biggest city, Debrecen, thus becoming the largest industrial investment in Hungary’s history.

Ultimate Risk

Some critics remain concerned that ‘China can also leverage local ties to influence EU decision making or undermine EU unity on certain issues, as well as build legitimacy for the Chinese regime back home’. Szijjarto has, nevertheless, appealed to critics that the future of relations between China and the EU ‘depends on whether Europe is ready to come back to rationality and common sense’. Indeed, he went so far as to say that Brussels should stop acting as ‘a teacher of the world’.

The ultimate risk, however, is that it appears that

the world’s ‘second largest economy’ is like a bubble waiting to burst.

In fact, Xi Jinping’s major policies that were introduced with great fanfare only to be abruptly discarded, often without even acknowledging their prior existence, have decoupled.

The Chinese Communist Party’s (CCP) breakneck shift from three years of ‘zero COVID’ policy, following a wave of protests in late 2022, is only the most conspicuous of these reversals, all of which can be ascribed to their role in undermining the credibility of the CCP and its leader.

In a Foreign Affairs article titled ‘Xi’s Plan for China’s Economy Is Doomed to Fail’, authors Zongyuan Zoe Liu and Benn Steil stated that, aside Xi’s prized policy of ‘common prosperity’ being short-lived, because Chinese lenders pay depositors far less than they would in a competitive market, such state-directed investment has resulted in ‘gross overbuilding in housing and infrastructure, accompanied by relentlessly declining productivity and soaring debt levels across the economy’.

‘Early signs suggest’, according to Liu and Steel, ‘that Xi’s consumption drive is already failing badly. In March 2023, Chinese exports surged by 14.8 per cent and imports declined by 1.4 per cent, producing a massive monthly trade surplus of 88.2 billion USD. These data reflect weak domestic demand and a corresponding need to push goods abroad—the opposite of consumption-led growth.’

The CCP, at the same time, cannot rely on its new generation of consumers to bail them out.

Youth unemployment, as of this past April, was at 20.4 per cent, thus further hurting the economy—6 million of the 96 million 16- to 24-year-olds in the urban labor force are currently unemployed. Undoubtedly, this, with a steady slump in the prices of copper and iron ore, have contributed to a 20 per cent fall in Beijing’s main stock market index this year.

The Hungarian Foreign Minister is correct in saying that a break with Beijing would be ‘a brutal suicide’, the reason why every G7 member state still maintains trade with the CCP. Yet there are possible alternatives.

Possible Alternatives?

Last June US President Joe Biden and Indian Prime Minister Narendra Modi hailed a new era in their countries’ relationship after the White House rolled out the red carpet for the Modi, touting deals on defence and commerce aimed at countering the CCP’s global influence. This may be a path to follow.

India’s economy has emerged as a bright spot in the aftermath of the COVID-19 pandemic. It recently surpassed the United Kingdom as the fifth largest global economy, and it is predicted to become the third largest by 2030. It is also expected to contribute 15.4 per cent to global economic growth this year, second only to China. Prioritising our trade and economic relationship with both countries should be a key goal Hungary, which could be expanded to investment in India’s natural resources.

There is also a way to deal with the world’s largest economy, for the US Dollar (USD) is not going to decline anytime soon.

Those who claim that the USD is in decline often argue that for centuries, reserve currencies have risen and fallen in tandem with their home economies. As the US’ share of the global economy diminishes, economists argue, so too will the USD and its global hegemony. A fascinating yet hardly conclusive argument since there has never been a dominant global reserve currency prior to the USD. Quite the contrary, the USD is the only currency ever to have played such a pivotal role in international commerce.

As Michale Pettis, Senior Fellow at the Carnegie China Center and Professor of Finance at Peking University, stated: ‘No other currency can replace the US dollar.’

This is primarily due to the fact that the US allows ‘capital flow freely across its borders and absorb the savings and demand imbalances of other countries’. In other words, says Pettis, the US ‘run[s] deficits to offset the others’ surpluses and allow[s] them to convert their excess production and savings into US assets by purchasing real estate, factories, stocks, or bonds. This pushes down global demand, forcing the United States to compensate, often with higher unemployment or debt’.

The present USD-based system is is composed of imbalances that are limited mainly by the willingness and ability of Washington to import or export claims on its domestic assets—to allow holders of foreign capital to be net sellers or net buyers of American real estate and securities. Yes, other countries can run large, persistent surpluses or deficits, but they can only do so because these imbalances are accommodated by opposite imbalances in the US.

Perhaps it may be in Hungary’s interest to not just look further East, like in India, but to restructure its financial endeavours with the US?