The following is a translation of an article written by Géza Sebestyén, Head of the Mathias Corvinus Collegium Economic Policy Centre, originally published on Növekedés.hu.

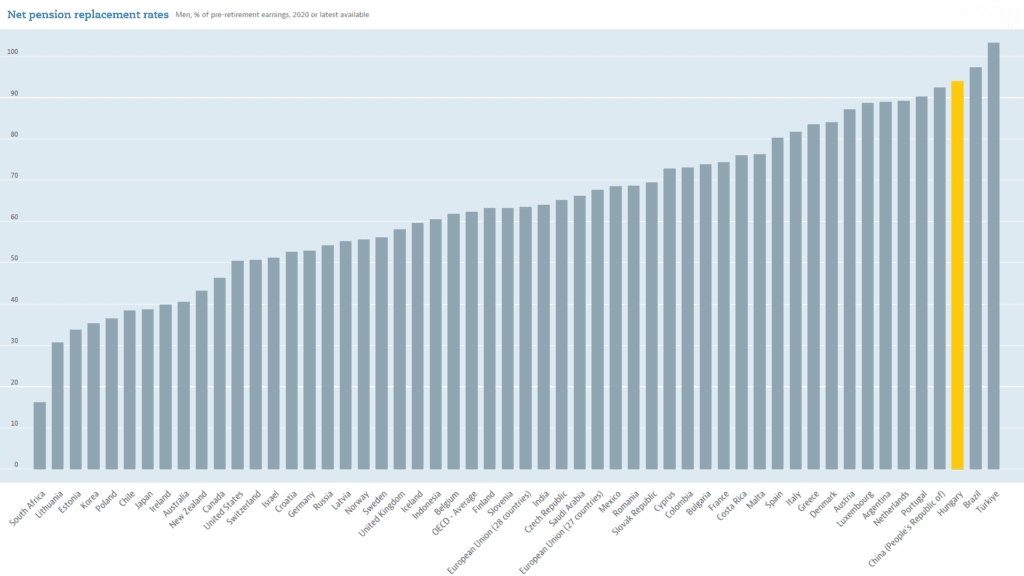

Retirement generates an income loss in all countries. However, Hungarian employees suffer the smallest decline in living standards after retirement in the whole of Europe.

Modest Retirement Years

The fact that a higher standard of living can be achieved with active work than with retirement is not surprising.

The economy’s revenues are generated by citizens currently working, so logically, they should be the first to benefit from the generated income. In addition, it would not be fortunate either if economic motives encouraged early retirement, namely if retired individuals had more income than those working 8+ hours a day.

However, the extent of the income loss is not irrelevant.

A significant drop in monthly income can cause serious social and societal problems. Besides, it would not be equitable either if citizens had to live in miserable conditions during their retirement years after a lifetime of work.

In economics, the net pension replacement rate has been devised as an indicator to quantify the changes in living standards after retirement. This ratio shows how, on average, the value of the starting pension compares to the earnings of the last period of work.

Based on the above, the indicator is naturally below 100 per cent everywhere. However, it matters a lot whether it is around 30 per cent or 90 per cent: in the first case, the living conditions of those who retire from work deteriorate dramatically, while in the second case only to a small extent.

Hungary, the Champion of Europe

According to OECD statistics, in the whole of Europe, Hungarians experience the least negative effects on the quality of life after retirement. As shown in the chart below, the indicator in question is at 94 per cent in Hungary, which is better than that of all other European states.

Even in the case of the runner-up European country, Portugal, the indicator is only at 90.3 per cent. That is, while the standard of living of Hungarian retirees deteriorates only by 6 per cent after their active working years, that of the Portuguese decreases by almost 10 per cent, which is still nearly twice the Hungarian figure.

The next European countries on the list are all developed Western European states. In the Netherlands, the indicator is at 89.2 per cent, in Luxembourg at 88.7 per cent, in Austria at 87.1 per cent, and in Denmark at 84 per cent.

Meanwhile, the other three V4 countries perform much worse than our country.

In Slovakia, only recent retirees receive 69.4 per cent of their income, and in the Czech Republic, the same rate is 65.2 per cent—that is, in these states, the quality of life decreases by almost a third at the end of working years. In Poland, the situation is even gloomier: the country’s indicator is at 36.5 per cent, which means that at the end of active working years, the income of Poles falls to a third of the original level.

For the two Baltic States at the bottom of the list, the situation is downright catastrophic. In Estonia, the first pension after retirement is only 33.8 per cent of the active income, while in the case of Lithuania, retirees have to content themselves with even less, only 30.7 per cent of their former wages.

In conclusion, we can confidently say that Hungary is the country that appreciates its retirees the most in the whole of Europe.

Click here to read the original article