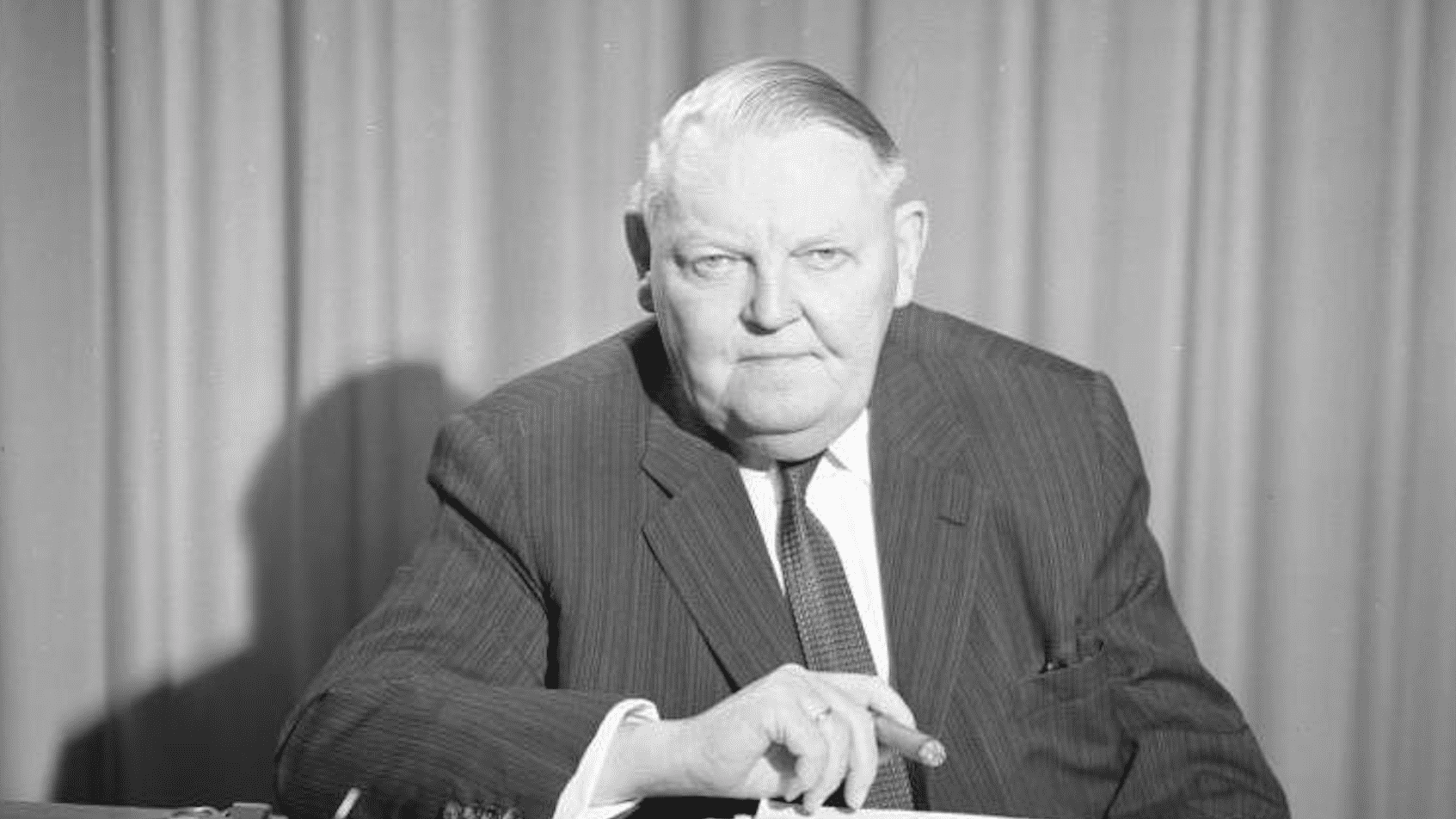

Few statesmen faced as serious a political and economic challenge as the reconstruction of a country following the bloodiest and by far the most destructive conflict the world had ever seen. Ludwig Erhard was confronted with an almost impossible task when he became the first minister of economy of the newly established Federal Republic of Germany in 1949. Twenty per cent of German housing had been destroyed by the end of World War II. In 1947, industrial production was around a third of what it was in 1938. The price caps of the war era led to massive shortages of food and other essential consumer goods. The old Reichsmark was losing its value rapidly. Many soldiers never returned home, a human tragedy and a serious blow to the German labour market at the same time. The unprecedented post-war crisis demanded bold action from economic policymakers. The lessons of the programme that Erhardimplemented and the German Economic Miracle offer valuable guidance in today’s time of economic calamity and of a war-stricken international system.

The Great Ordoliberal Experiment

West German post-war economic policy was quite unique compared to the policies followed by Germany’s European counterparts. The need to manage post-war economies gave rise to the popularity of central planning, state intervention and eventually, of the welfare state amongst Europe’s economic intelligentsia. Germany, mainly thanks to Ludwig Erhard, followed a different path. Erhard was highly influenced by the idea of ordoliberalism and the ‘social market economy’ popularised by the Freiburg school of economics, most notably by Walter Eucken and Wilhelm Röpke.

The main tenets of ordoliberalism hold that free markets provide the best way of resource allocation and that free markets should operate in a framework defined by the ‘policy of order’ (Ordnungspolitik). In this respect, ordoliberalism differs from laissez-faire liberalism often associated with the pro-market stance. Ordoliberals believe that the state should create the legal framework necessary for the operation of the market. They are in favour of a strong central bank with a mandate of preserving price stability, disciplined fiscal policy and strict competition, as well as of antitrust laws to prevent the creation of monopolies and cartels. Besides, ordoliberals support limited redistribution through taxation.

Free markets provide the best way of resource allocation

Erhard’s commitment to free market ideas could hardly be taken for granted, given that his times preceded the economic liberal revolution of the later decades. The starting point and magnum opus of free market thinking, Friedrich August von Hayek’s The Road to Serfdom came out only in 1944. Still, Erhard’s experience under wartime planning and his staunch opposition to Nazism led to a vision that upheld the superiority of the free market not only for economic, but for social reasons as well. Erhard realised how harmful and many times fatal governments and the state can become. In free markets, he saw not only an efficient tool of resource allocation, but also a guarantee for the protection of civil liberties, human rights and independence from a potentially evil and destructive power. As a man of ideas, he was determined to put these principles into practice. That is how the post-war stabilisation began and the German Economic Miracle was born.

The Lessons of the German Economic Miracle

The post-war German economic calamity was due to two serious problems. The first was a huge blow to two factors of production, namely to German capital stock that was destroyed during the war and to labour, with the large number of potential workers who never returned from the front. The second problem was the rapid depreciation of the German currency, the Reichsmark. As wartime price controls still applied, the currency’s depreciation led to widespread shortages, rationing and the blossoming of the black market. The situation was so serious that barter trade amounted to almost half of all transactions in 1947. Therefore, the task was quite clear for economic policymakers. First, industrial output had to be increased through the replacement of German capital stock. Second, money supply had to be reduced in order to stop inflation and therefore incentivise production at the same time. Ludwig Erhard did exactly that.

In 1947, Erhard became the director of the Anglo-American Office of Economic Opportunity. In order to reduce money supply and stop inflation, the Office enacted a currency reform in 1948. The new German mark (DM) replaced the old Reichsmark at an exchange rate of 1 D-Mark to 10 R-Marks, a drastic, 93 per cent reduction in money supply followed. Although many Germans saw a huge reduction in their net wealth, the decrease in inflation incentivised savings once again, which ultimately made the great post-war reconstruction possible. Monetary rigour was the first important contributor to the German Economic Miracle.

At the time of the currency reform, Erhard realised that while price caps and price controls are completely ineffective in fighting inflation, they lead to massive shortages and they disincentivise production in a time of serious need for economic revival. Therefore, despite huge opposition from both the Americans and his own advisors, Erhard abolished most price control measures just a few weeks after introducing the new Deutsche Mark. The step proved to be quite effective, as shortages disappeared almost overnight. As soon as producers saw that they can earn valuable currency in exchange for consumer goods, without having to sell under the market price, they became incentivised to produce more. At the same time, workers returned to the job market as the money they earned proved to be valuable again. Price liberalisation was the second important contributor to the German Economic Miracle.

Erhard cut taxes both on personal income and corporate profits

The post-war economic revival couldn’t have been achieved without rebuilding the German capital stock and increasing the participation of the labour force in the job market. New investments required increased savings. That is why the fight against inflation was of paramount importance. At the same time, Erhard cut taxes both on personal income and corporate profits. Lower taxes incentivised saving, investment and a return to the labour market as the government let households and workers keep more of what they earned. Erhard knew that keeping taxes high in the middle of a serious economic downturn would inhibit economic growth. At the same time, the arrival of German refugees from Eastern Europe and the proceeds of the Marshall Plan also helped to increase investments and the available labour force. Lowering taxes was the third important contributor to the German Economic Miracle.

The Message for Today’s Policymakers

Ludwig Erhard’s economic reforms led to astonishing economic growth and revival. Between 1948 and 1958, industrial output grew at an average annual rate of 15 per cent. Only in the second half of 1948, following the currency reform, industrial production grew by a staggering 50 per cent. By the end of the decade, the unemployment rate was down to 1 per cent. Two-digit post-war inflation decreased immediately after the currency reform and stabilised around a sustainable rate of 3 per cent by 1954. Erhard realised that sustainable economic growth can only derive from an increase in productivity. Therefore, capital accumulation through increased savings and investments were essential in post-war reconstruction. Low taxes and keeping inflation under control also contributed to the economic success.

The main tenets of Erhard’s programme still apply today. Lax fiscal policy and monetary stimulus do not result in long-term, sustainable economic growth. Prosperity is ultimately a result of increasing productivity. Low taxes, low inflation, monetary rigour and the uninterrupted operation of the free market are essential in order to achieve prosperity. A never-ending expansion in the size of the state, largely ignored increases in inflation, a fiscal policy governed by changes in political rule and interventions into the price mechanism are all inhibitors of economic growth in today’s world. Ludwig Erhard and the German Economic Miracle provide great guidance that current policymakers had better follow.